The top 10 industries using outdoor roadside advertising

26th November 2023

The entertainment and leisure industry is spending almost two and a half times as much on outdoor roadside advertising than any other industry, according to new data.

Outdoor advertising operator 75Media analysed Nielsen Ad-Intel data provided by Outsmart, which shows that the entertainment and leisure industry claimed more than 27% of the total spend on out of home (OOH) roadside advertising in the UK.

The next highest spending industry is drinks, which had 12.1% of the total spend, closely followed by food at 10.5%.

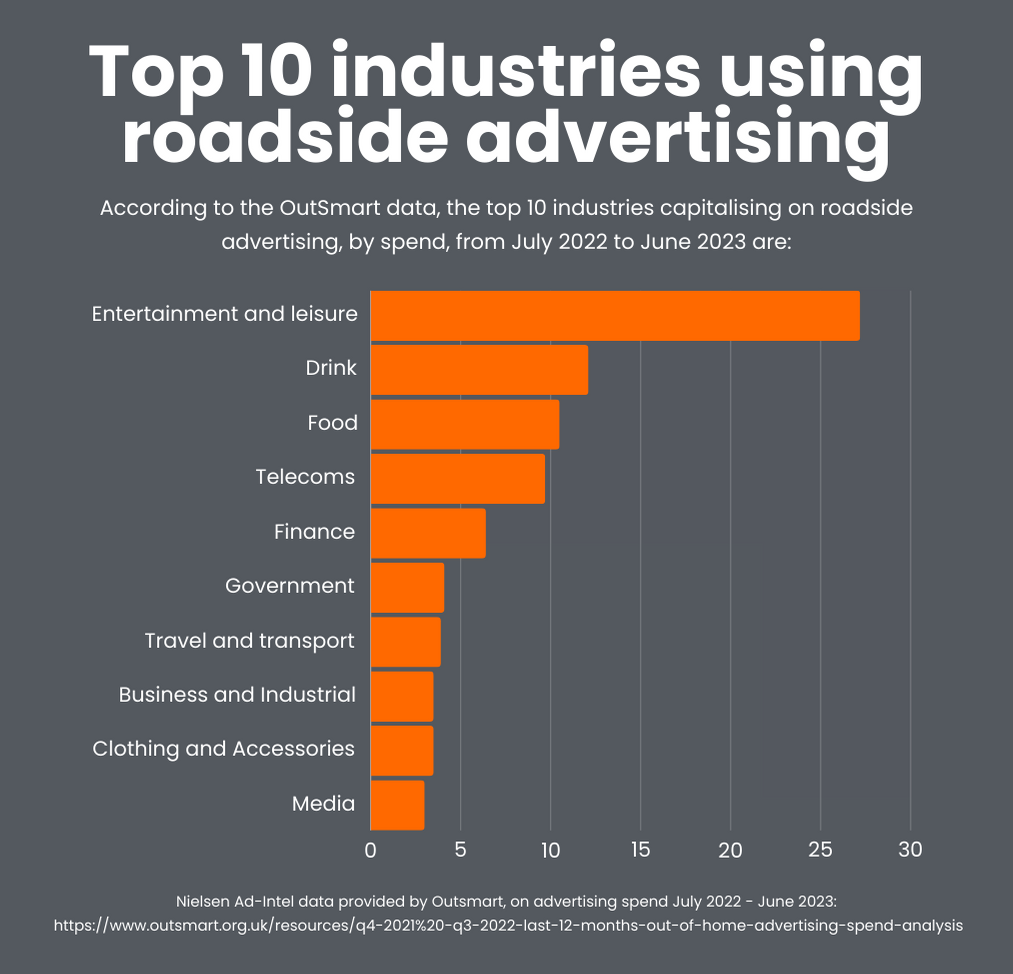

According to the data, the top 10 industries capitalising on roadside advertising, by spend, from July 2022 to June 2023 are:

Entertainment and leisure – 27.2%

Drink – 12.1%

Food – 10.5%

Telecoms – 9.7%

Finance – 6.4%

Government – 4.1%

Travel and transport – 3.9%

Business and Industrial – 3.5%

Clothing and Accessories – 3.5%

Media – 3%

Other sectors combined made up 16.6% of spend.

Comparing the top 10 with end of year data from 2022, business and industrial is a new sector to the top 10 – replacing motors. Looking specifically at data from the first half of 2023, cosmetics also features on the list.

During the last 12 month, McDonald’s was the top spender on roadside advertising, spending over £78 million. The next biggest advertiser was EE, with a spend of £36 million, followed by Coca Cola GB at £32 million. However, looking purely at 2023 spend, although McDonald’s retains top spot, taking second place is Unilever UK Ltd and in third place is KFC.

75Media also analysed its own sales data to find the most frequently represented sectors amongst its client base. Joel Turner, Commercial Director at 75Media, commented: “Of course, many campaigns come to us through marketing and advertising agencies, so they form a large part of our client base. But we also work with many thousands of businesses and organisations directly. Interestingly, healthcare and higher education came very high on our list, although they don’t currently feature in the overall national top 10.

“Retail, real estate and construction are also prevalent in our client base. What the top 10 sectors demonstrate is that an extremely broad range of organisations can benefit from OOH – and the top spenders certainly show what faith they have in outdoors as a successful path to increasing sales and brand awareness, given the large budgets in play.”

According to data provided by Outsmart and PwC, the OOH industry continues to demonstrate impressive growth. Total revenues for the first half of 2023 were £554m, which is a +4.7% growth compared to the same period in 2022. Almost two thirds (63%) of advertising spend in OOH is on digital sites. There has been a 282% increase in digital roadside screens in the last five years, from 3,000 in 2018 to over 12,000 at the start of 2023*.

For more information visit https://75media.co.uk/blog/top-ten-industries-leading-ooh/